Social Token Mid-Year Report

Pocket-sized numbers edition of “Social Token Refresh” essay published in collab with Cooopatroopah.

In 2021, the total market cap of key Social tokens surpassed $303m, a ~500% growth from 2020.

The amount of addresses holding social tokens grew by ~200% from 6000 to now 19,000

$BANK is the most widely held social token, with over 3,955 holders. $WHALE comes close with 3,856 holders followed by $FWB with 3,459.

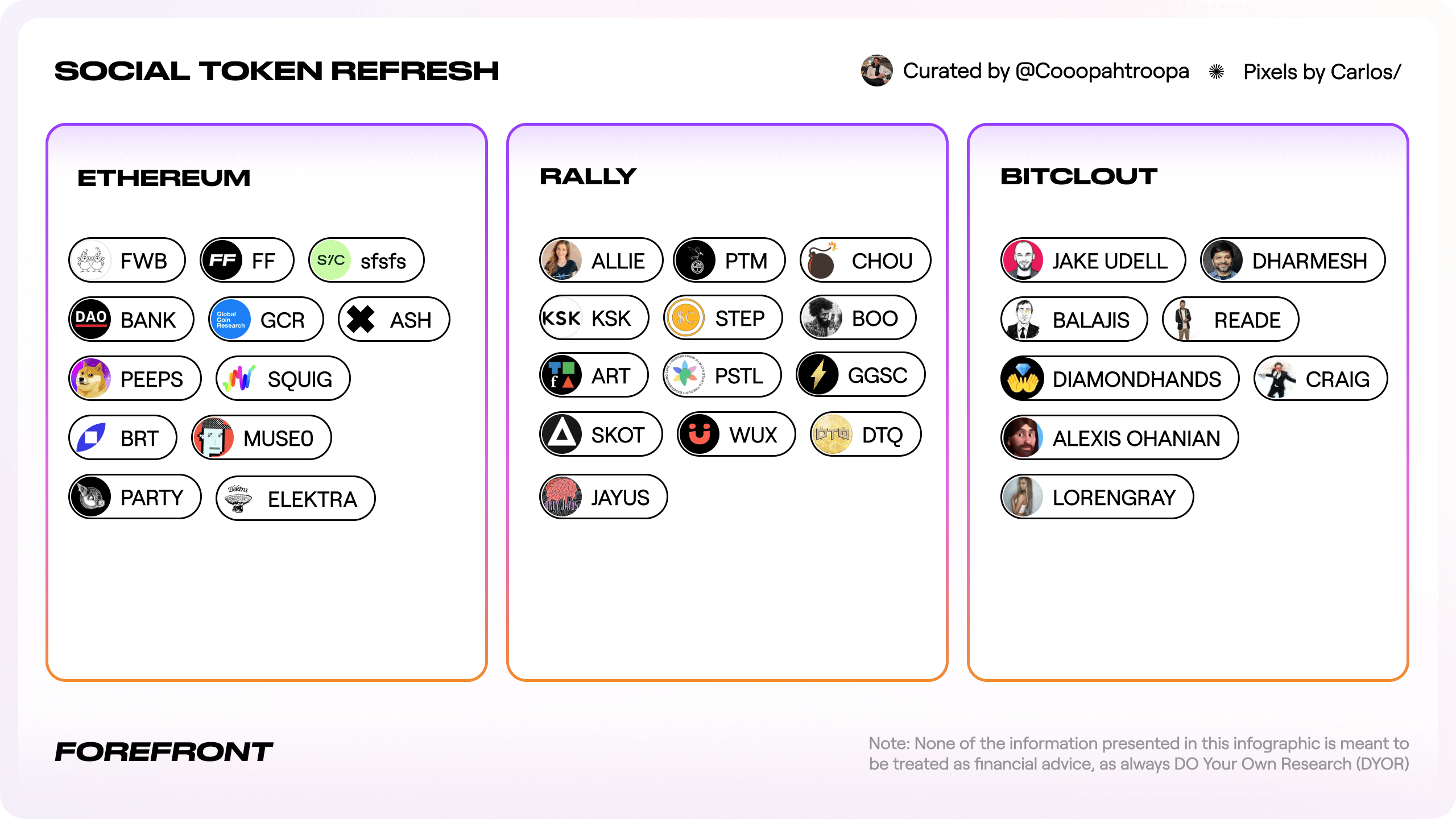

New Players. Three Main Ecosystem. Mainnet, Rally, Bitclout.

This year alone Coinvise has helped more than 280 communities and creators launch a social token.

Rally backed creator coins are starting to show the first sign of mainstream crossover thanks to influential creators with established audiences via Twitch, TikTok, Spotify and Instagram.

Three key themes to recap 2021 in social token

Seasons

Via Friends with Benefits, Forefront, Gitcoin and Bankless DAO.

March Hack

Roll - a social token issuer - was hacked. One rogue actor sold ~$5.7m tokens on the open market across communities like FWB, WHALE, and JULIEN.

Raises

Social token projects secured years of runway to build the infrastructure for a community owned future. Notable raises included Forefront, FWB, Coinvise, Rally, Bitclout and Seed Club.

Check out FF Learn for more on Social tokens

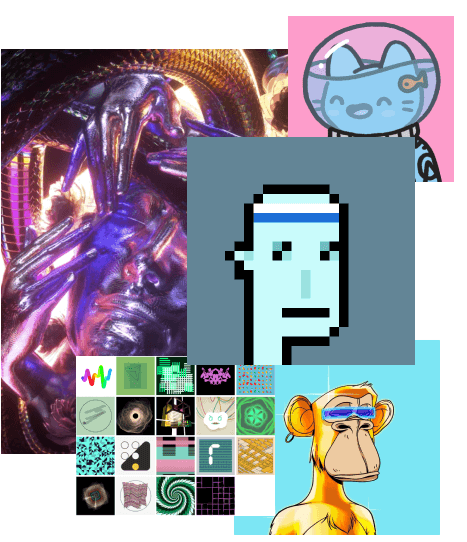

NFTs blew up in 2021. Like literally!

NFT sales is 2021 increased by 30,000%, from $94.8m in 2020 to $13 billion in 2021.

Profile Picture NFTs (aka PFPs) and generative art are to blame. Notable mentions CryptoPunks, Bored Ape Yacht Club (BAYC), Pudgy Penguins and many others.

OpenSea is the go to marketplace. The platform is on track to surpass $27.5 billion in volume for 2021.

Decentralized players in the space like Zora and soon to launch "Shoyu" by Sushi are the ones to watch.

Horonable Mentions.

The Game Changers.

The Loot Project flipped the script on NFTs.

Axie Infinity pioneered the new play-to-earn craze.

Mirror, digital publishing meets community meets NFTs meets Public Goods.

What's Next

- DAO Servicing

- Legal Structures

- Governance Frameworks

- Treasury Diversification

- IRL Vibes

- Lots of GM(s)

For more in depth details on the projects, tools and professionals driving the social token space forward, Follow Forefront on Twitter

...also

Disclaimer: We recognize that this report is not fully inclusive of all social projects in the space. The authors of this report are associated with many of the projects mentioned in this recap and have done their best to remain unbiased. None of the information presented in this report is meant to be treated as financial advice and we recommend that all readers do their own research. Data by FF Social Token Analytics, Coingecko.